What is the Medicare levy surcharge and when are you required to pay it?

The Medicare levy surcharge is designed to encourage people with higher incomes to take out private patient hospital cover. You may be liable for the Medicare levy surcharge if you exceed the relevant income threshold without an appropriate level of private health insurance.

The Medicare levy surcharge is additional to the Medicare levy. The Medicare levy is a tax Australians pay to cover the costs of our public health system (Medicare). The Medicare levy is 2% of your taxable income and automatically calculated and applied when you lodge your tax return. Typically, the Pay As You Go (PAYG) amount your employer withholds from your wages includes a portion to cover the Medicare levy.

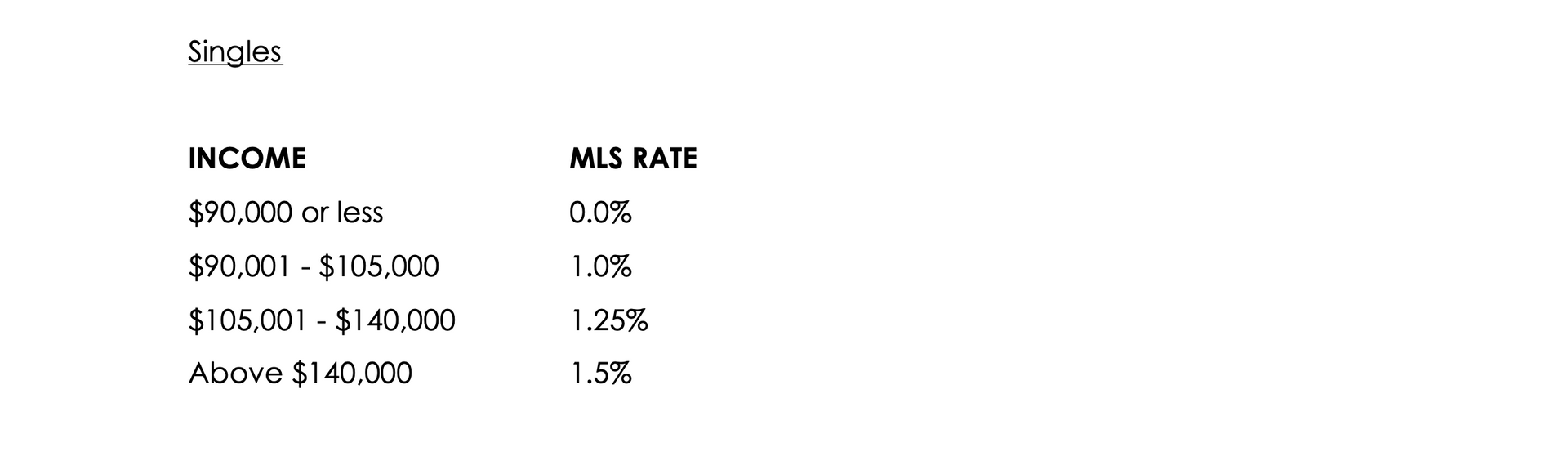

The Medicare levy surcharge is levied against an individual’s taxable income, on top of the Medicare levy, when they don’t have the appropriate level of private hospital cover. Below we’ve outlined the Medicare levy surcharge rates for the 2022-23 financial year.

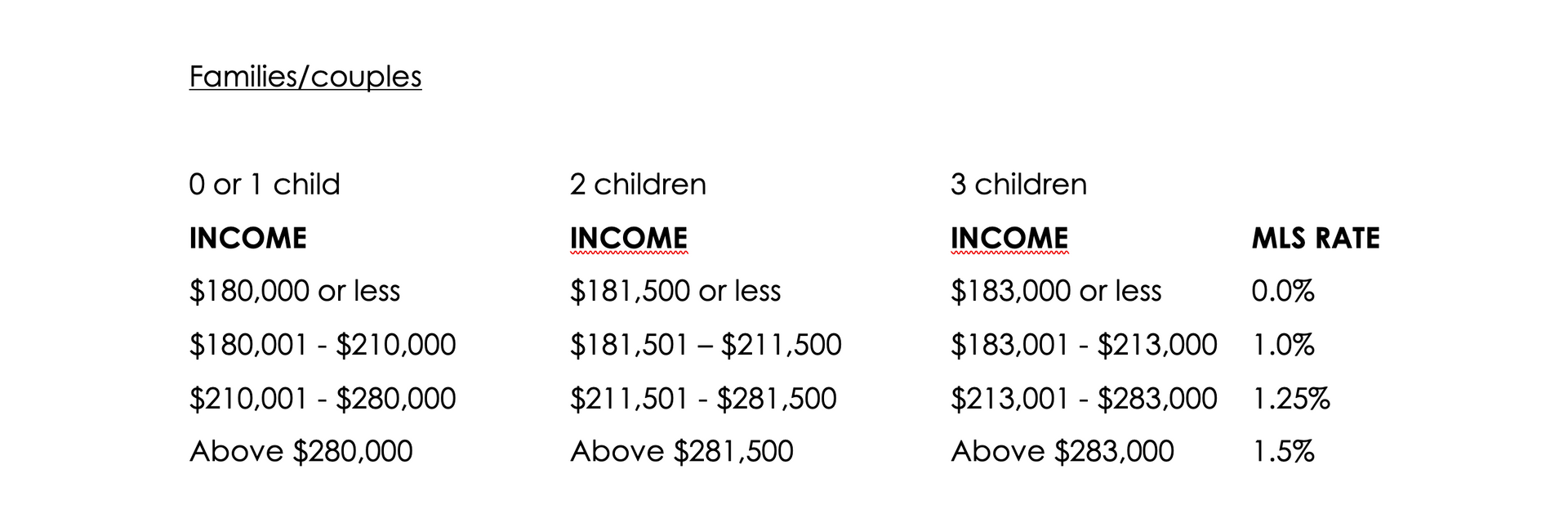

Medicare levy surcharge (MLS) rates

For each additional child, the income threshold increases $1500.

While a couple’s combined income is used to determine whether the Medicare levy surcharge applies, the actual surcharge is applied individually based on each person’s taxable income. For example, if one partner earns below the low income threshold ($24,276 for 2022-23), they are not liable for the Medicare levy surcharge regardless of the combined income.

Should a taxpayer’s family circumstances change during the year (e.g., they marry or separate), the Medicare levy surcharge is calculated for each period separately, reflecting their circumstances at the time.

Paying the Medicare levy surcharge

When you lodge your tax return, if it’s determined you’re required to pay the Medicare levy surcharge, it will be combined with the Medicare levy and show as one item (Medicare levy and surcharge) on your notice of assessment.

Preparing your tax?

We know tax season can be a real headache, so we’re here to help. For accountants you can depend on for efficient and expert tax preparation, contact Ascent Accountants today.

Need help with your accounting?