Enjoy the retirement you deserve: 7 common mistakes to avoid with your money after retirement

If you’ve worked hard all your life to save for retirement, you want to be able to afford the lifestyle you deserve when you reach the “promised land”.

You shouldn't have your plans derailed by making retirement money mistakes or have to make sacrifices later in life because you've spent your money too quickly.

With that in mind, we look at the most common mistakes that you’re at risk of making with your money after retirement – and what you should be doing instead.

7 common retirement money mistakes to avoid

1. Not taking control of your super

Whether you choose to take your superannuation as an allocated pension, a lump sum, or annuity, it's important that you understand what your options are for accessing your superannuation when you retire.

2. Not knowing your entitlements

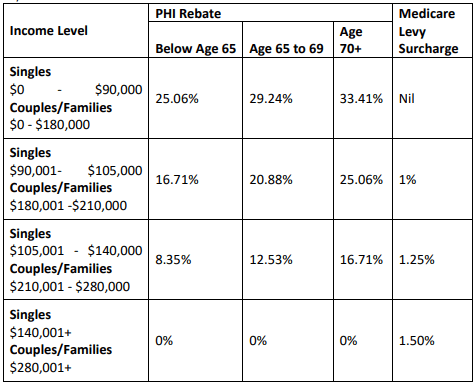

Make sure you know what payments you’re eligible for in retirement. This may include government benefits such as the age pension, disability support, a carer's allowance, or concessions on items such as travel and health.

3. Spending like you’re still working

Dipping into your savings or superannuation money regularly will quickly whittle away your hard-earned savings. It’s important to manage your cash flow and keep an eye on your expenses.

4. Not managing your investments

Just because you’ve retired doesn’t mean you can become complacent about your investments. It’s crucial to consider your personal situation. Consulting with a professional advisor can bring you the peace of mind that your investments are being managed in the best way possible.

5. Not managing your debts

To ensure that you have enough money to last you through retirement, it’s important to make sure that you’re not paying too much interest on your debts. If you still need to pay off your home loan, understand how selling your property will affect any entitlements you receive.

6. Spending your retirement savings on your children

If you want to give money to your children or grandchildren to help them out financially, it’s important to be aware of how gifting money or becoming guarantors for them might affect your tax situation - and therefore your future lifestyle.

7. Letting your insurance lapse

Although it may be tempting to cut back on certain things like insurance in retirement, be aware that, in 2017, almost 62% of insurance claims (received by just one provider) were made by people aged over 50. In short, you need to ask yourself if insurance is really something you can afford to be without.

Get help with managing your money after retirement

So, how do you plan wisely for your retirement so you can still enjoy the good things in life once you’ve stopped working?

It’s simple. Contact a professional with expertise in retirement planning.

Ascent Accountants help retirees in Perth create retirement strategies that balance immediate needs with longer-term retirement needs.

Contact us to see how we can help you do the same.

Need help with your accounting?