2018 Changes / Key Announcements

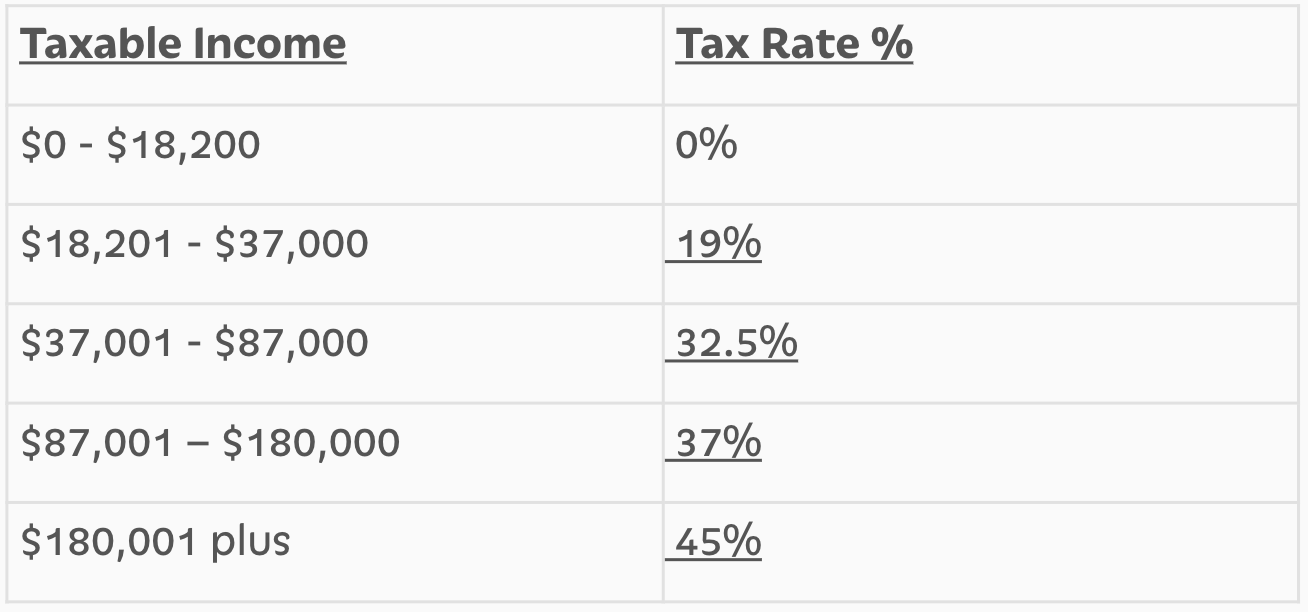

1. Personal Income Tax Rates

2017/2018 Financial Year

(plus 2% Medicare levy where applicable)

*There is no 2% budget repair levy from 1st July 2017.

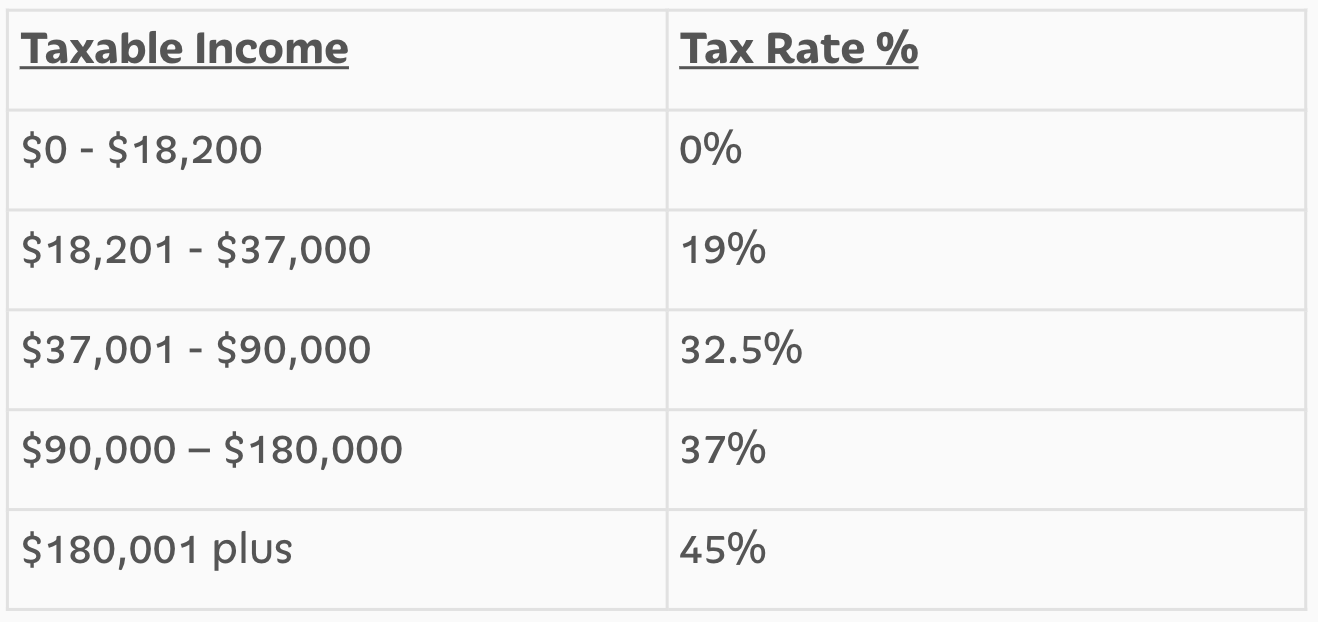

2018/2019 Financial Year

(plus 2% Medicare levy where applicable)

*It is proposed from 1st July 2022 that there will be an increase in the tax thresholds to reduce the tax paid by taxpayers.

Note: The low income offset is $445. This offset will reduce by 1.5 cents for every $1 of taxable income over $37,000. It phases out when the taxable income is $66,667

2. Medicare Levy – Low Income Threshold

For the 2017/2018 income year, Medicare Levy will be incurred when the incomes are above:

- Individuals $21,980

- Families $37,089

Plus $3,406 for each dependent child.

The Medicare levy will now stay the same at 2.0% from 1st July 2019.

3. Motor Vehicle – Statutory Formula

A) FBT for Business

The Statutory Formula method to calculate the taxable value of the private use (Fringe Benefit) of a vehicle is a flat 20% statutory rate of the cost of the car. It is no longer based on kms travelled per year.

Important Note: Keeping a valid 3 month logbook is extremely important!

B) Cents per KM for Individuals

The Motor Vehicle Statutory Formula claim for the cents per kilometre for individuals will stay at 66 cents per kilometre for 30th June 2018. There is only one single rate for all engine sizes. Individuals will only be able to claim cents per kilometre method or logbook method. You can no longer claim 12% of original value method or one third of actual expenses method from 1st July 2015.

4. Superannuation Contributions (concessional)

The maximum amount that taxpayers can contribute into superannuation as concessional contributions are:

Year ending 30th June 2018 Year ending 30th June 2019

Age under 49 $25,000 max Age under 49 $25,000 max

Age 49 and above $25,000 max Age 49 and above $25,000 max

Important Notes:

- From 1st July 2017, all individuals under the age of 75 can claim an income tax deduction for personal superannuation contributions. There will be no more 10% test to claim a tax deduction for personal contributions. Therefore, partially self-employed and partially employed (wages) and individuals whose employers do not offer salary sacrifice arrangements will benefit from proposed changes. Once you reach 65 years of age, you must satisfy the work test.

- From 1st July 2018, individuals with a superannuation balance of less than $500,000 can make additional concessional contributions if they have not used all their cap in the previous 5 years, on a rolling basis on unused amounts accrued from 1st July 2018.

- From 1st July 2019, an exemption from the work test for voluntary contributions to superannuation for people aged 65-74 with superannuation balances below $300,000 will be introduced.

- From 1st July 2019, the government will increase the maximum number of allowable members in new and existing SMSF’s from four to six.

5. Superannuation Contributions (non-concessional)

The non-concessional contribution cap (contributions for which you do not claim an income tax deduction) is:

2017 – 2018 Income Year $100,000

2018 - 2019 Income Year $100,000

People aged under 65 years may be able to make lump sum non-concessional contributions of up to three times their non-concessional cap over a 3 year period (lump sum $300,000 in 2017/2018)

Important Notes:

- From 1st July 2017, non-concessional contributions can only be made if your total superannuation balance is under 1.6million.

6. Superannuation Changes

- From 1st July 2017, the government has removed the tax exemption on earnings of assets supporting Transition to Retirement income streams, being income streams of individuals over preservation age but not retired. The earnings will be taxed at 15% and the change is proposed to apply irrespective of when the Transition to Retirement commenced.

2. From 1st July 2017, the government has introduced a $1.6million superannuation transfer balance cap on the total amount of accumulated superannuation an individual can transfer into pension phase. Under the proposed changes:

- Subsequent earnings on this pension balance will not be restricted

- If an individual accumulates amounts in excess of $1.6million they will be able to maintain this excess amount in accumulation phase account (where earnings will be taxed at the concessional rate of 15%)

Important: fund members in pension phase with balances above $1.6million will be required to reduce this balance to $1.6million by 1st July 2017.

- From 1st July 2017, the low income spouse superannuation tax offset income threshold for low income spouses will increase to $37,000 (from $10,800). The offset will phase out when income reaches $40,000. The low income spouse offset provides up to $540 per annum when $3,000 is contributed into your spouse’s superfund.

- From 1st July 2017, First home buyers can voluntarily contribute up to $15,000 into Super ($30,000 in total). The contributions must be with existing concessional and non-concessional caps. From 1st July 2018 these contributions can be withdrawn (plus earnings) for a first home deposit.

- From 1st July 2018, people aged 65 or over can make non-concessional contributions into superannuation of up to $300,000 from proceeds of selling their home. These non-concessional contributions will be in addition to the caps, age tests and the $1.6million balance test.

7. Net Medical Expense Rebate

For 30th June 2018 financial year, you can only claim net medical expenses offset on aged care, disability aids and attendant care expenses. There is no more rebate on other net medical expenses for 2017 or future years.

8. Minors (Children under 18 years)

Families distributing money to children from Family Trust’s will need to be aware that they can only distribute $416 tax free for 30th June 2018 year.

9. Additional Tax on Superannuation Contributions – High Income Earners

In the 30th June 2018 year, Individuals with income greater than $250,000 will have their super contributions taxed at 30% and not 15% (this has been in place since 1st July 2012).

Note:

- Income is taxable income plus reportable fringe benefits, reportable superannuation contributions and any total net investment loss

- Super contributions include super guarantee and salary sacrifice

- The tax is payable by the individual client not the superfund however you can apply to have the money released from your superfund.

10. Superannuation Guarantee

From the 1st July 2018, the SG rate will stay at to 9.5 per cent. This will remain until 2021 and then increases will be by 0.5 per cent each financial year until 12 per cent is reached. The proposed future increases each year are:

Financial Year Minimum Superannuation Guarantee Rate

2017/18 9.50%

2018/19 9.50%

2019/20 9.50%

2020/21 10.00%

2021/22 10.50%

2022/23 11.00%

2023/24 11.50%

2024/25 12.00%

For individuals to claim a deduction for personal contributions, you must have a valid written notice (deduction notice) advising you intend to claim a tax deduction and a written acknowledgement from the superfund.

11. Changes To Family Trusts And Income Resolutions

Trustees must ensure that trust income is distributed by an income distribution resolution/minute by the 30th June 2018. These resolutions must show what trust income each beneficiary is entitled to, and the streaming of franked dividends and capital gains if applicable.

Trusts with older deeds should have these reviewed to ensure the definition of income complies with current legal definitions in the tax act and that the deed allows for streaming of capital gains and franked dividends. The trust deed must also state all required beneficiaries.

12. Changes to Rental Properties

a. From 1st July 2017, travel expenses will be disallowed for inspecting, maintaining or collecting rent for residential rental properties.

b. From 9th May 2017, investors who purchase residential investment properties will only be able to claim depreciation on plant and equipment on new acquisitions of plant and equipment

- Investors who purchase new plant and equipment can still claim depreciation after 9th May 2017

- From 9th May 2017, investors cannot claim depreciation on any plant and equipment that was purchased with the property or was used previously for private use

- Existing property investors, before 9th May 2017, can continue to claim depreciation

- All investors can continue to claim the depreciation on the building costs from 9th May 2017

c. From 1st July 2019, the government will deny deductions for expenses associated with holding vacant residential or commercial land, including interest on finance for the acquisition of the land. Deductions for expenses associated with holding land will be available once a property has been constructed, it has received approval to be occupied and is available for rent. Denied deductions will not be able to be carried forward for use in later income, however, denied deductions can be included in the cost base of the land.

13. Changes To Private Health Insurance Rebate And Medicare Levy Surcharge

The private health insurance rebate is now income tested and the Medicare levy surcharge will be increased based on your income if there is no appropriate private hospital cover for the year. The following table summarises the changes to the private health insurance (PHI) rebate and the Medicare levy surcharge based on the income levels from the 1st April 2017 (the rebate % has decreased from last year):

(For families with more than one dependent child, the relevant threshold is increased by $1,500 for each child after the first)

14. Change To Depreciation

Small businesses with aggregate annual turnover of less than $10 million can immediately deduct assets they start to use or install ready for use, provided the asset costs less than $20,000 (GST excl). This will apply for assets acquired and installed ready for use at 30 June 2018. Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed in the small business simplified depreciation pool (‘the pool’) and depreciated at 15% in the first income year and 30% each income year thereafter. The pool can also be immediately deducted if the balance is less than $20,000 over this period (including existing pools). It is proposed that this concession is to extend until 30th June 2019.

Note: this is for small business entities, not employees or rental properties

15. Increase Small Business Entity Turnover Threshold

For 30th June 2018 and 30th June 2019, the Small Business Entity (SBE) turnover threshold is $10million. This will allow businesses (with turnover less than $10million) to access:

- Lower (27.5%) corporate tax rate (businesses with $25million turnover can access this)

- Simplified depreciation rules (including immediate deduction for an asset purchased costing less than $20,000 until 30th June 2019)

- Simplified trading stock rules if their stock has changed by less than $5,000

- Option to account for GST on cash basis

Note: the $2 million turnover threshold will be retained for small business capital gains tax concessions.

16. Higher Education Loan Programme (“HELP”) & Trade Support Loan (TSL) – repayment thresholds

For 2018/2019 the threshold and repayment rate to pay back debt is:

Repayment Income Repayment Rate

Below $42,000 Nil

$42,000 – $44,520 1.00%

$44,520 - $47,191 1.50%

$47,191 - $50,022 2.00%

$50,022 - $53,024 2.50%

$53,024 - $56,205 3.00%

$56,205 - $59,577 3.50%

$59,577 - $63,152 4.00%

$63,152 - $66,941 4.50%

$66,941 - $70,958 5.00%

$70,958- $75,215 5.50%

$75,215 - $79,728 6.00%

$79,728 - $84,512 6.50%

$84,512 - $89,582 7.00%

$89,582 - $94,957 7.50%

$94,957 - $100,655 8.00%

$100,655 - $106,694 8.50%

$106,694 - $113,096 9.00%

$113,096 - $119,882 9.50%

$119,882 and above 10.00%

Australians who have a HELP or TSL and are residing overseas, will be required to make repayments against their debt from 1st July 2017 based on their 2016/2017 worldwide income. Overseas debtors are required to update their contact details via MyGov within 7 days of leaving Australia.

17. Small Business Income Tax Offset (SBITO)

For the 30th June 2018 financial year, individuals will receive a 8% tax discount as a non-refundable tax offset on business income. This includes Sole Traders, Partners in Partnership and Trust Distributions where the entity carries on a business. The entity must be a small business entity with a turnover of under $5million. The tax discount will be capped at $1,000 per individual for each income year.

18. Reducing the Company Tax Rate

For the 30th June 2018 financial year, the company tax rate for small businesses is 27.5% (reduction of 2.5%) for companies with aggregated annual turnover of less than $25million. Companies with aggregated turnover of $25million or above or who are not carrying on a business will continue paying tax at 30% on all their taxable income.

Note: the current maximum franking credit rate for distribution will be 27.5% for these companies in 2017/2018.

19. Zone Offset Change

From 1st July 2015, all FIFO (Fly In, Fly Out) and DIDO (Drive In, Drive Out) workers will not be able to claim the zone rebate for the zone they work in. The zone rebate entitlement will only relate to the zone of their normal place of residence. Taxpayers who actually reside in a zone can continue to claim the zone rebate.

20. Supersteam Requirements for Employers and SMSFs

Employers must make Superannuation contributions on behalf of employees by submitting payments and data electronically. Superannuation Funds (including SMSFs) must receive contributions from employers (that are not related parties of the SMSF) electronically. The start date for Superstream was 1st July 2016.

Businesses need to setup the free ATO clearing house or a clearing house with another company to arrange the Superstream compliance. SMSFs need to obtain an electronic service address and this is setup through a messaging provider. If you require help setting this up, please contact us.

21. Reducing Claim Period for Family Assistance Lump Sum Claims

Families that choose to wait until the end of the financial year to claim their FTB entitlement or child care benefit will have a grace period of one year. Therefore, all 2017 tax returns must be lodged by 30th June 2018 and all 2018 tax returns must be lodged by 30th June 2019.

Reminder of Things to Consider Before 30th June

- Consider making the $1,000 personal contribution to qualify for the super co-contribution before the 30th June if your taxable income will be below the thresholds.

- Consider making a spouse contribution into superannuation if you qualify for the rebate.

- Ensure your 3 month logbooks have been kept on vehicles.

- Make sure you have receipts for your tax deductions.

- Review the need to sell capital assets to obtain any capital losses if you have made any capital gains during the year.

- Obtain/prepare a summary of child support paid during the year if you are paying child support or child support you may have received, if you are receiving.

- Businesses:

- Make sure you have odometer readings for all work vehicles.

- Super must be paid for staff by the 28th July. However to get the deduction in the 2017/2018 year it must be paid before the 30th June (or received by Superfund if paid by transfer).

- PAYG Summaries must be issued to all staff by the 14th July.

- Trust Resolutions/Minutes for all trusts must be prepared and signed before 30th June 2018.

- Businesses in the building and construction industries must lodge their payment annual reports for payments made to contractors during the year by 28th August 2018. From 1st July 2018 this will also include cleaning and courier industries.

- Individuals:

- Home office claim – ensure you have a 4 week diary recording hours worked from home for work. Must be kept to claim home office deduction.

- Internet claim – ensure you have kept a 4 week diary recording internet usage (hours used for work/hours used personally) to support your work internet claim. This must be kept to claim home internet as a work deduction.

- Motor Vehicle deduction – ensure you keep a 4 week diary of vehicle kilometres used for work to support the tax deduction.

Need help with your accounting?