Tax Invoices

Tax Invoices

Requirements of Tax Invoices

It is important that you review the Tax Invoices your business is supplying when you sell goods or services. The GST laws are specific on what is required to be included on Tax Invoices.

Once a business is GST registered a tax invoice must be issued by a supplier. (You do not need to supply a tax invoice where the value of the supply does not exceed $75.00). If your business is not GST registered an ordinary invoice should be supplied. There should be no reference to "tax invoice" or "GST" on an ordinary invoice.

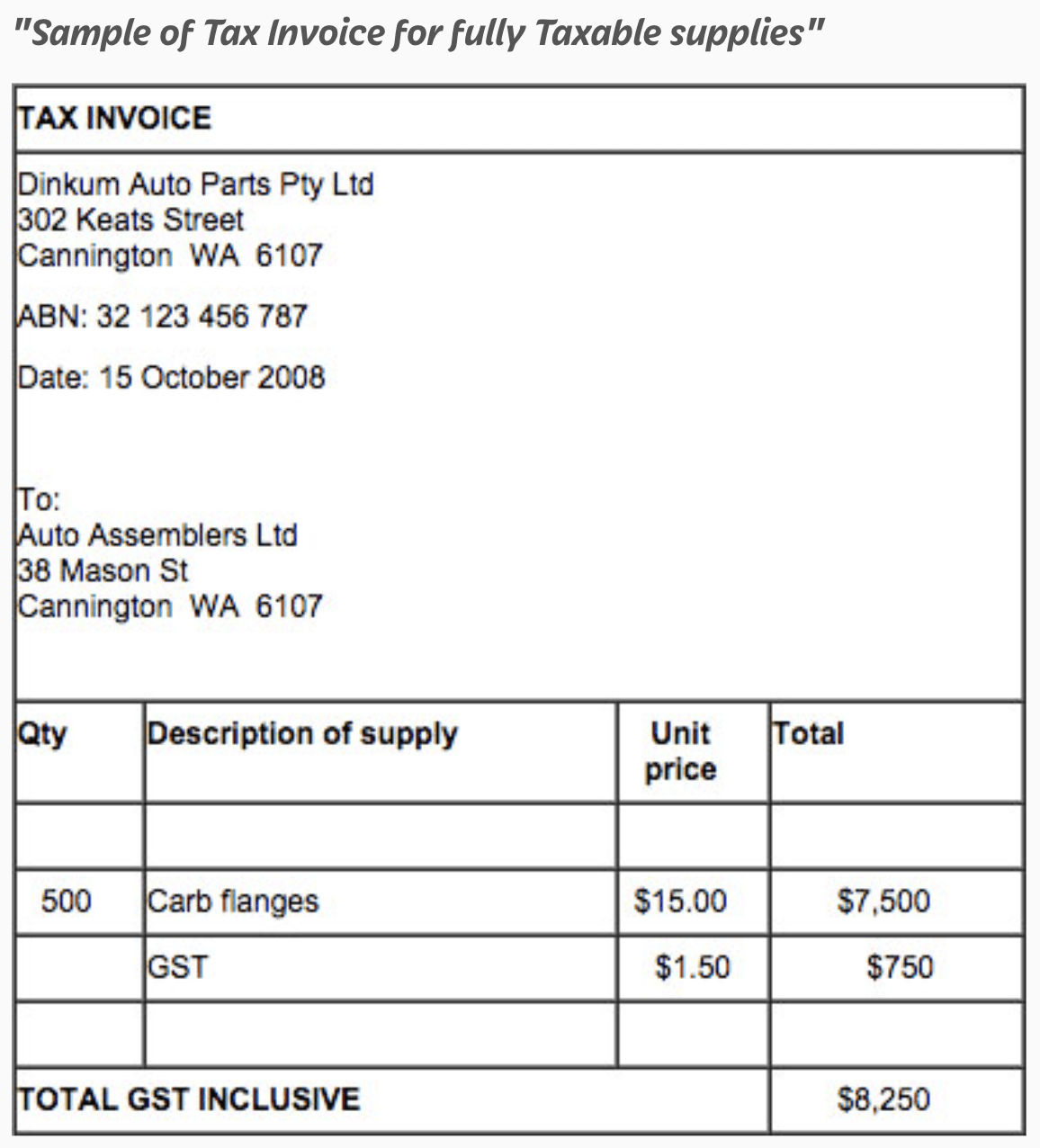

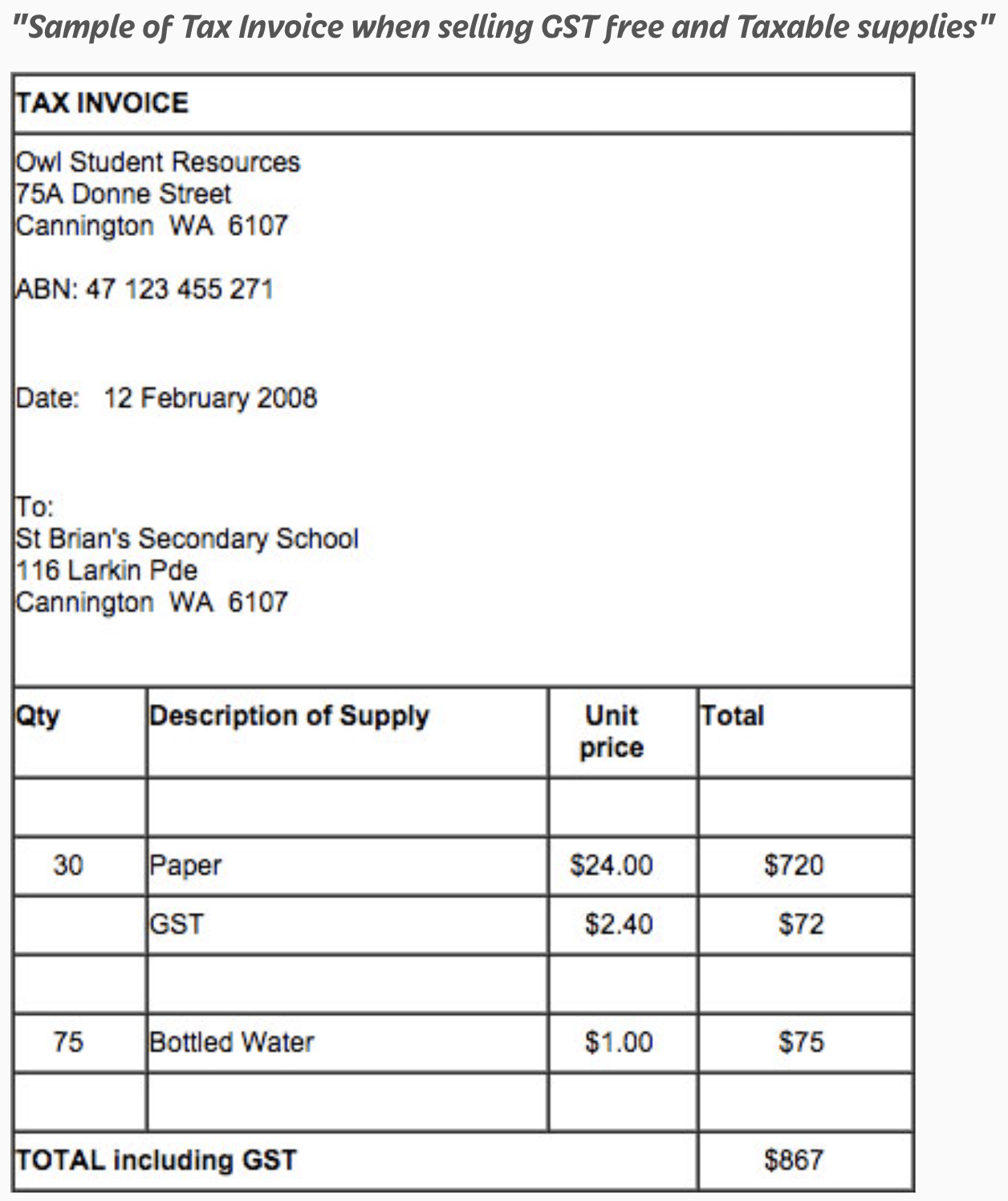

A "Tax Invoice" supplied by a GST registered business must:

- Prominently state the words "Tax Invoice"

- Set out your business name (or trading name)

- Include your ABN number on the Tax Invoice

- Include the purchasers name (or trading name). This isn't necessary if Amount Payable is less than $1,000

- Include the purchasers address (or ABN). Again this isn't necessary if Amount Payable is less than $1,000

- Include date of issue

- Contain a brief description of each thing supplied. (If the Amount Payable is $1,000 or more the quantity of goods/services supplied must be included)

- Contain on the Tax Invoice:

a) The total amount of the GST payable (the total of the GST on this Tax Invoice) or

b) If the GST is 1/11th of total Price (no GST free items) the Tax Invoice can include a statement of "GST Inclusive".

If you are concerned that your Tax Invoices do not comply with the above rules, or you require further information please contact us for further advice and clarification.