Gearing Shares

Negative Gearing into Shares

Negative Gearing is when an investor borrows to purchase a mix of equity in publicly listed shares, fixed interest securities, property or units in a Unit Trust. The Income received from investing in an income producing asset is less than the interest payment on the loan.

The investor claims the excess of interest paid on the borrowings over income received from the asset. Borrowing to buy shares or units is an efficient, tax effective method of BUILDING WEALTH.

Gearing enables investors to increase the size of their overall portfolios thereby providing an opportunity for greater capital growth in respect of the original amount invested.

Borrowing to invest makes sense when the value of the assets acquired increases more than the rate of interest.

Negative Gearing into shares or unit trusts is a long term investment due to the volatility of the sharemarket.

Advantages of Negative Gearing into Shares

- The share market is the best performing long term investment

- Multiplies your profits (also multiplies losses). For example if you have $5,000 to invest and you borrow an extra $5,000. You purchase 10,000 AMP shares at $1.00. After 2 weeks you sell your 10,000 AMP shares for $1.30 a share giving you $13,000. After paying back the loan of $5,000 you have made $3,000 which is a return of 60% on your money. If you only invested your $5,000 you would have made $1,500 or 30%

- Maximise after Tax Profits

- Cost of borrowed money is a Tax Deduction if invested in dividend paying shares

- Shares/Units are a very liquid investment. They can be bought and sold within an hour

- If you invest in shares/units paying a franked dividend the income you receive could be Tax Free and the credits can be used to offset other income

Example of how Franking Credits work:

- Most shares pay a dividend or distribution twice a year. The rate of dividend depends on the type of industry you invest in

- You fully participate in any increase in the asset value, but you only put up a fraction of the cost yourself.

- Dividends offset the borrowing costs

- Gearing enables a larger investment exposure

- With Franking Credits, unused franking credits will be refunded

- With the new Capital Gains Tax laws investing in individual names provides a discounted capital gain

Disadvantages of Negative Gearing into Shares

- Increases the risk

- The asset values may fall

- If the asset values fall, lenders may require the security on the loan to be topped up. This may mean that assets may need to be sold at a loss to increase the security on the loan

- If interest rates move the wrong way gearing may work against you

- Cashflow from other sources may dry up and you have trouble making the difference between interest payments and net investment income

- With short term loans the risks increase due to the volatility of the sharemarket

Suggestions

Always know the risk involved and realise you can lose as well as win. The longer you invest for the less risk involved.

If you don't know much about shares or you don't have time to follow them closely, the Managed Funds provide the same exposure and benefits as listed above but the work is done for you.

Always keep in mind your debt/equity ratio. This will always change in accordance with how risk adverse you are and advancing to different stages in your life.

Marginal Lending is becoming the most popular way of Negative Gearing into shares and Unit Trusts because it is an interest only loan and there is no repayment date. However there are Marginal Calls if your debt/equity ratio falls below a certain level.

Please contact us if you would like to find out more about the above or if you would like more information.

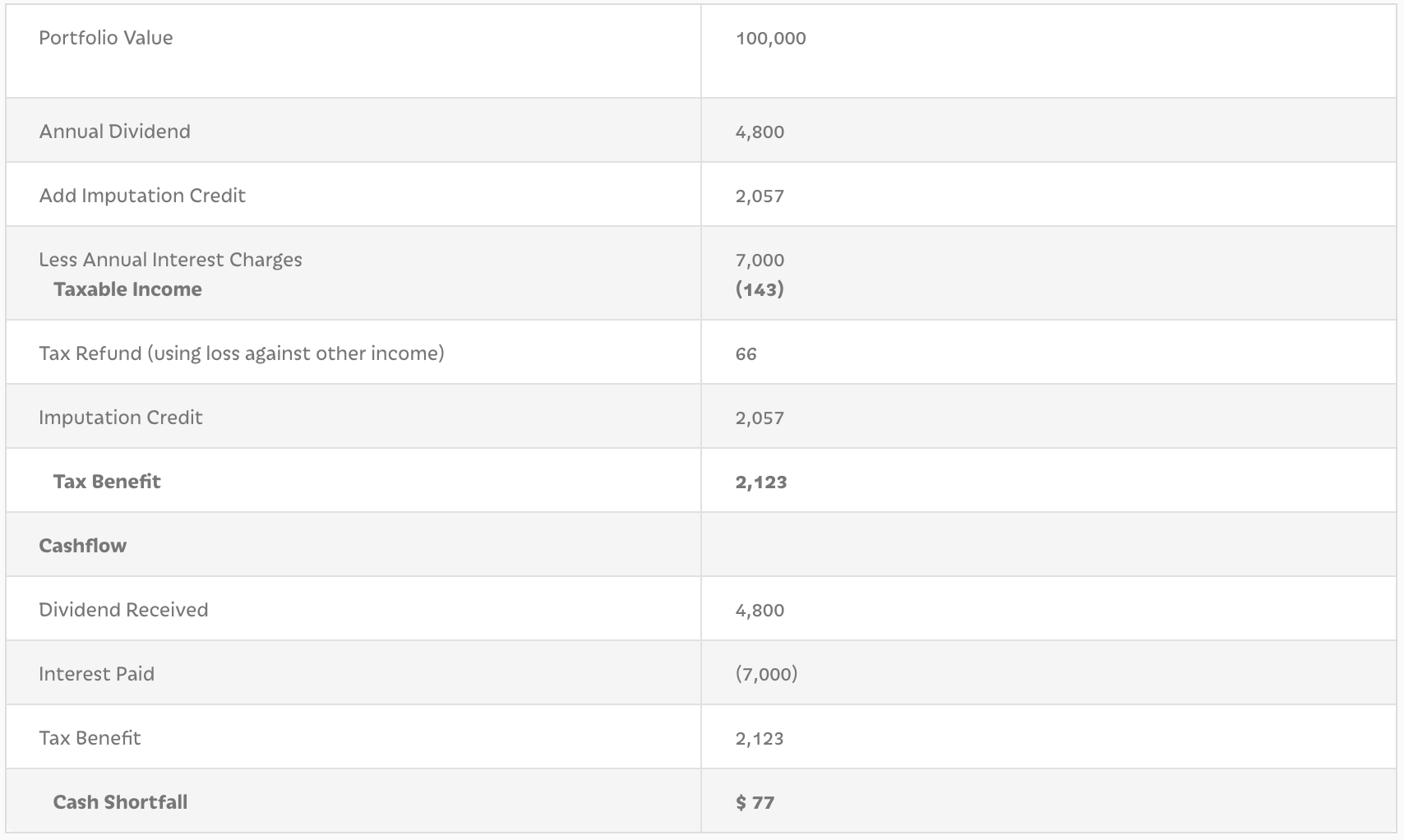

Worked Example of Negative Gearing using Marginal Lending

Based on the income and payments for shares. Other income not taken into consideration. Assumptions $70,000 loan, $30,000 contributed. Dividend yield 4.8% Interest Rate 10% 46.5% Tax Rate.